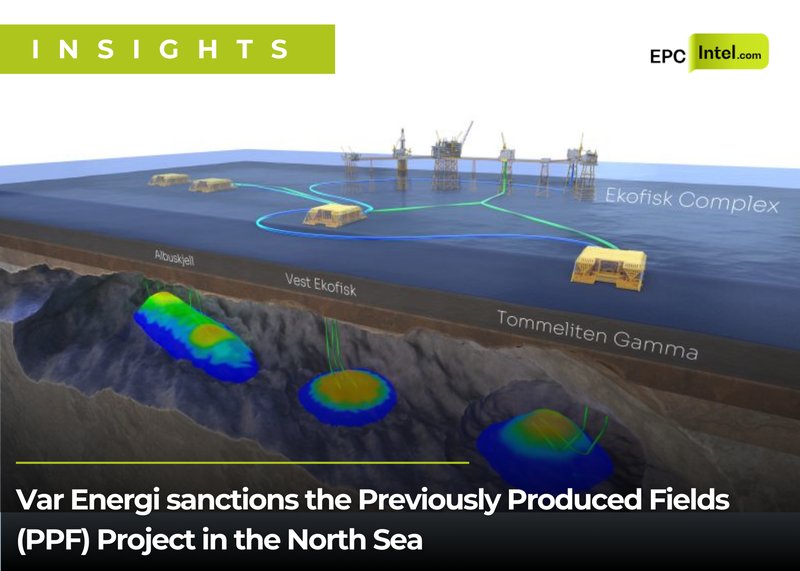

Var Energi and its partners have sanctioned the Previously Produced Fields Project in the Greater Ekofisk Area, targeting incremental recovery from reservoirs that have already been on stream. Operated by ConocoPhillips Skandinavia AS, the project is designed to bring additional volumes on stream from 2028 while extending the productive life of the wider Ekofisk hub.

The development is expected to deliver around 55 mmboe of net proved plus probable reserves. With a breakeven price below USD 35 per boe, rapid capital recovery, and an expected return above 25 percent, the project aligns squarely with the partners’ capital discipline and portfolio optimization strategy.

More strategically, PPF underpins the ambition to sustain production of 350 to 400 kboepd toward 2030 and beyond. Rather than chasing frontier exposure, the partners are doubling down on infrastructure led developments that monetize known resources at low unit cost.

Brownfield strategy at work

PPF is a textbook example of modern North Sea brownfield execution. The project focuses on selective infill drilling, sidetracks, and targeted tie backs into existing facilities across the Greater Ekofisk Area. By leveraging platforms, processing capacity, and export infrastructure already in place, capital intensity is kept firmly under control.

This approach significantly reduces schedule risk and exposure to supply chain volatility. It also allows development decisions to be taken quickly, with a shorter cycle time from sanction to first oil compared with greenfield projects.

For operators, the attraction is clear. Brownfield projects like PPF deliver resilient economics across a wide oil price range while maintaining high recovery factors and strong cash flow generation. For the Norwegian shelf more broadly, it reinforces the role of mature hubs as long term production anchors.

EPC and contracting outlook

From an EPC and supply chain perspective, PPF does not translate into a single headline EPC award. Instead, value is distributed across multiple packages, favoring contractors with deep brownfield and offshore execution experience.

Based on EPCIntel.com benchmarking for comparable Ekofisk area developments, total non drilling capital expenditure for PPF is likely to fall in the USD 1.8 to 2.3 billion range.

Drilling and well related services typically represent the largest share of spend, often accounting for 45 to 50 percent of total capex on projects of this nature. This includes rig time, well construction, completions, and associated services. The key beneficiaries are drilling contractors, OCTG suppliers, directional drilling specialists, and integrated well services providers with a strong North Sea footprint.

Brownfield engineering, procurement, and construction activities are expected to represent around 20 to 25 percent of total spend. This scope covers detailed engineering, topside modifications, hook up work, and offshore installation campaigns. EPCIntel.com data suggests these packages typically range from USD 350 to 500 million, favoring established North Sea EPC contractors with long standing Ekofisk experience.

Subsea equipment and installation is estimated to account for 15 to 20 percent of project spend. This includes subsea trees, controls, umbilicals, manifolds, and tie in operations. Typical values for this segment range from USD 300 to 400 million, depending on final well count and configuration.

A further 5 to 10 percent of capital is usually allocated to maintenance, modifications, and life extension work. These scopes are often executed through framework agreements and smaller call off contracts, providing steady work for a wide range of Norwegian and regional suppliers.

Why Ekofisk still matters

While 55 mmboe may appear modest in a global context, the importance of PPF lies in its economics rather than its scale. Low cost barrels with fast payback remain highly attractive in an upstream market defined by selective capital allocation.

Ekofisk’s continued reinvestment highlights the strategic value of infrastructure ownership. Once platforms, pipelines, and processing facilities are in place, incremental developments can deliver outsized returns relative to capital deployed. This is particularly relevant as operators seek to balance shareholder returns with long term production resilience.

For the supply chain, projects like PPF provide visibility and continuity rather than boom and bust cycles. Smaller, repeatable scopes favor contractors that are embedded in the North Sea ecosystem and capable of executing safely and efficiently in a mature offshore environment.

Outlook

With sanction secured and first production targeted from 2028, the PPF Project adds another layer of longevity to the Greater Ekofisk Area. As capital discipline remains central to upstream investment decisions, similar brownfield developments are expected to dominate Norwegian project sanctioning over the coming years.

For EPC contractors and suppliers, PPF is less about a single contract award and more about sustained opportunity. It reinforces a clear message from the Norwegian shelf, mature assets, when managed with discipline and technical depth, continue to deliver competitive returns well into the next decade.