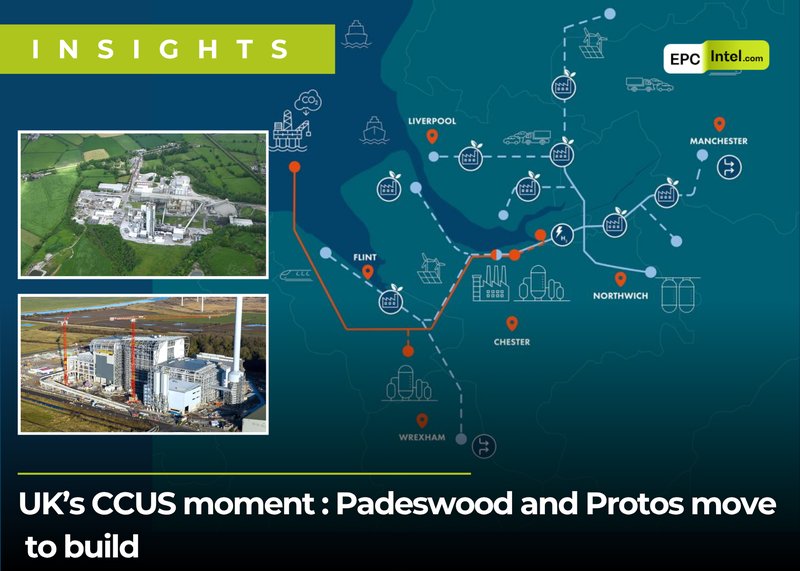

The UK’s carbon capture and storage (CCUS) rollout is shifting from plans to execution, with two landmark HyNet cluster projects — Heidelberg Materials’ Padeswood CCS plant in North Wales and Encyclis’ Protos ERF CCS facility in Ellesmere Port—now officially moving into the construction phase. Together, they mark a defining moment in the UK’s decarbonisation strategy and signal the start of commercial-scale carbon capture deployment in heavy industry and waste-to-energy.

Two firsts for the UK

The Padeswood CCS project is the world’s first carbon capture facility designed to enable fully decarbonised cement production. Heidelberg Materials’ investment will allow the existing Padeswood cement plant to capture and permanently store up to 800,000 tonnes of CO₂ per year, effectively transforming one of the UK’s most carbon-intensive materials into a low-carbon product.

At Protos Energy Recovery Facility (ERF) in Ellesmere Port, Encyclis has given Notice-to-Proceed to Kanadevia Inova to begin building the UK’s first full-scale carbon capture installation at an Energy-from-Waste plant. Using amine scrubbing technology, the facility will capture around 370,000 tonnes of CO₂ annually from the combustion of non-recyclable waste, integrating seamlessly into the operational WtE plant.

Both projects will link into the HyNet CO₂ pipeline network, transporting captured emissions to Liverpool Bay for permanent offshore storage in depleted gas reservoirs operated by Eni.

Part of the HyNet Track 1 cluster

The two projects anchor HyNet’s Track 1 industrial cluster, one of the UK government’s flagship carbon capture initiatives, designed to decarbonise industrial zones across North West England and North Wales. Together, they represent a combined capture capacity of 1.17 million tonnes of CO₂ per year, equivalent to the carbon absorption of nearly 19 million tree seedlings grown for a decade.

EPCIntel.com view: supply chain opportunities ahead

With both projects now entering construction, EPCIntel.com estimates a combined total investment of around USD 1.7–1.9 billion, spread across civil works, process units, utilities, and CO₂ compression and handling systems.

Estimated package breakdowns:

-

Capture units (amine system, absorber, stripper, heat exchangers) – USD 350–400 million combined across both sites, led by process technology licensors and modular fabricators.

-

CO₂ compression, dehydration, and export systems – USD 180–220 million, including motor-driven compressors, chillers, and interconnecting pipelines.

-

Balance of plant and utilities – USD 250–300 million, covering water treatment, steam generation, electrical and control systems.

-

Civil, mechanical, and installation contracts – USD 500–600 million, largely benefiting UK-based EPC and construction contractors.

-

Transportation and storage (pipeline tie-in to HyNet) – USD 350–400 million, part of Eni’s Liverpool Bay CO₂ infrastructure rollout.

Key UK and European contractors are already positioning for secondary packages in fabrication, civil works, module assembly, and commissioning. Equipment suppliers in compressors, heat exchangers, and gas cleaning technologies are also expected to compete for orders.

Decarbonisation at industrial scale

The Padeswood and Protos projects demonstrate the industrial viability of carbon capture in sectors traditionally seen as hard to abate. Heidelberg Materials’ plant will become the first cement works in the world to achieve near-zero emissions through full capture and storage, while Encyclis’ initiative at Protos will redefine waste-to-energy’s role within a circular, low-carbon economy.

With HyNet’s CO₂ transport network progressing in parallel, these two projects form the front line of a broader CCUS buildout expected to cover refining, hydrogen, and power generation assets across North West England.

For the UK supply chain, this marks the start of a multi-decade CCUS build cycle. EPCIntel.com expects the HyNet cluster alone to generate over USD 10 billion in cumulative contract opportunities through 2035, spanning CO₂ capture plants, pipelines, and offshore storage hubs.

As construction begins at Padeswood and Protos, EPC and technology providers are finally seeing years of development studies translate into real steel on the ground—a critical inflection point for Britain’s decarbonisation journey.