Overview

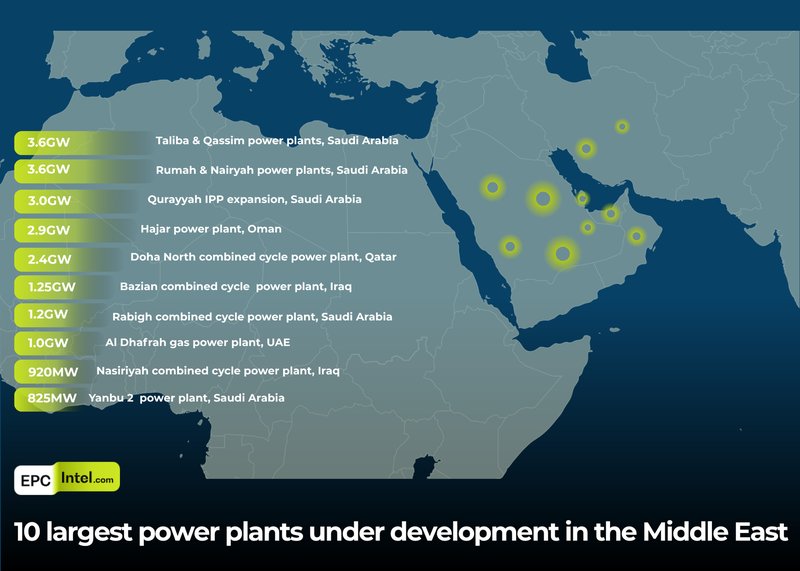

Middle East is undergoing a historic transformation in its power generation mix, driven by the development of a new wave of high-efficiency natural gas-fired power plants. Ten major combined-cycle projects—collectively exceeding 21 GW of capacity—are currently under development across Saudi Arabia, Oman, Qatar, Iraq, and the United Arab Emirates. Together, they represent the region’s largest coordinated gas-power investment in over a decade, as governments move to replace oil-fired capacity, stabilize grids, and enable large-scale renewable integration.

Saudi Arabia Leads the Regional Build-Out

EPCIntel.com data shows that Saudi Arabia accounts for more than half of all natural gas power capacity currently under execution in the Middle East, with over 10 GW under construction or advanced development.

The Taliba and Qassim power plants—each rated at 1.8 GW and expected to be executed by Hyundai Engineering & Construction and Doosan Enerbility anchor this expansion. Both projects are hydrogen-ready combined-cycle facilities that will play a pivotal role in the Kingdom’s Vision 2030 strategy to shift from crude oil to lower-carbon gas generation.

The twin Rumah and Nairyah plants, totaling another 3.6 GW, are being executed under two major EPC consortiums: one led by Siemens Energy and Harbin Electric, and the other by Mitsubishi Power, KEPCO, and ACWA Power. These projects will deploy state-of-the-art H- and J-class gas turbine technology, delivering world-leading thermal efficiency.

Further south, the Qurayyah IPP Expansion—a 3 GW project awarded to Orascom Construction and Técnicas Reunidas, with GE Vernova supplying turbines, extends one of the world’s largest combined-cycle complexes. Designed with carbon-capture readiness, Qurayyah sets a benchmark for sustainable thermal generation. Smaller but strategically important projects such as the 1.2 GW Rabigh and 825 MW Yanbu 2 units on the Red Sea coast will replace aging oil-fired assets and enhance industrial power reliability.

Diversifying Energy Capacity in Oman and Qatar

Outside Saudi Arabia, EPCIntel.com tracking identifies two large-scale projects reshaping regional gas generation. In Oman, the 2.9 GW Hajar Power Plant is moving through EPC tendering, with Samsung C&T and Daewoo E&C among shortlisted bidders. The project will supply Oman’s northern grid and reinforce post-LNG energy diversification.

In Qatar, the 2.4 GW Doha North Combined-Cycle Power Plant, developed by Mitsubishi Power, Toshiba, and Hyundai E&C, will deliver high-efficiency baseload power to support the country’s LNG export and industrial expansion strategy. Equipped with ultra-low NOx combustion systems, it will be among the cleanest gas-fired units in the region.

Iraq’s Push for Gas Utilization and Grid Stability

Iraq’s growing pipeline of gas-to-power projects, part of a national drive to capture flared gas and expand generation capacity. The 1.25 GW Bazian Combined-Cycle Power Project in the Kurdistan Region—developed by Mass Energy with ENKA and Siemens Energy, is set to become the region’s key IPP, feeding the northern grid. Meanwhile, the 920 MW Nasiriyah CCGT in southern Iraq, executed by ENKA and GE Vernova, will convert open-cycle capacity to high-efficiency combined-cycle operation. These projects are central to Iraq’s strategy of transforming gas flaring into reliable electricity supply.

The UAE Strengthens Its Low-Carbon Baseload

In the United Arab Emirates, the 1 GW Al Dhafrah Gas Power Plant, is being developed by TAQA in partnership with Mitsubishi Power. Designed as a hydrogen-ready combined-cycle facility, it will underpin Abu Dhabi’s low-carbon baseload mix and complement the emirate’s expanding solar and nuclear capacity.

Technology, EPC Landscape, and Investment Trends

All ten projects listed in the EPCIntel.com database share common technological hallmarks: H-class or J-class gas turbines, hydrogen co-firing capability, and carbon-capture readiness. These plants will achieve efficiencies above 60%, setting new regional standards for performance and emissions.

The EPC market is increasingly consolidated around a core group of Tier-1 international contractors—Siemens Energy, GE Vernova, Mitsubishi Power, Técnicas Reunidas, Hyundai E&C, Doosan Enerbility, ENKA, and Samsung C&T—working closely with national utilities such as SEC, ACWA Power, TAQA, and PDO. Collectively, these projects represent more than $25 billion in EPC contract value, with staggered commissioning between 2027 and 2030.

Strategic Outlook

Middle East’s gas power expansion is not a delay in decarbonization but the foundation for it. By replacing oil-fired plants with ultra-efficient, hydrogen-ready combined-cycle units, the region is creating the flexible baseload backbone needed to balance growing renewable capacity.

Once operational, this new generation of gas plants will collectively avoid millions of tonnes of CO₂ annually, while securing power reliability and enabling future hydrogen and ammonia integration. The result is a pragmatic, transitional energy model—one in which natural gas remains the bridge between today’s power needs and tomorrow’s net-zero systems, firmly positioning the Middle East as a global leader in low-carbon thermal generation.